Where Have All the Aggressive Growth Stocks Gone?

- John-Mark Young

- Aug 17, 2025

- 5 min read

At Whitaker-Myers, we build our portfolios using the simple framework made famous by Dave Ramsey: Growth, Growth & Income, Aggressive Growth, and International. Technically, it becomes more complicated and requires a significant amount of brainpower from individuals like our Co-Chief Investment Officer, Summit Puri, and our investment committee, which is involved in portfolio construction and asset allocation (the process of distributing investments). However, the four-category model serves as a framework that keeps investing understandable and disciplined. One of our most-read articles ever was written by Logan Doup, titled "Understanding Dave Ramsey's Four Categories of Investing." We also did a video that was quite popular; you can watch it here.

Within this framework, Aggressive Growth is where we seek companies with the potential to grow faster than the rest of the market. In our terms, this generally refers to mid-cap and small-cap stocks—the younger, smaller businesses that still have a lot of room to grow.

But here’s the challenge: true small-cap investing is getting harder and harder to find. And it’s not because those companies don’t exist—it’s because many of them are staying private longer, thanks to all the capital flooding into private equity.

Think about our friend Elon Musk. Tesla is publicly traded, and many of you are likely invested in it individually or through your retirement fund. For example, the Invesco QQQ (ticker: QQQ or QQQM) currently holds Tesla as its 8th largest holding, accounting for 2.75% of the portfolio. The Vanguard S&P 500 (ticker: VOO) currently holds it as its 10th-largest holding at 1.61%. But how many of your funds are invested in SpaceX? The Boring Company? Neuralink Corporation? X? Xai? SolarCity? Of course, you aren't invested in any of those, more likely because they are still raising the capital they need in the private markets. One could argue that those are the companies under Elon's control that you would want to invest in. Their hypergrowth is happening right now - not when they go public, even though growth will likely still exist after an IPO.

Why the Shift?

According to research from Marquette Associates, which can be read here, private markets have exploded over the last two decades. Private equity firms have raised massive amounts of “dry powder” (investable cash) and are funding businesses through multiple stages of growth. The average Series D round of funding has grown from about $50 million in 2014 to nearly $200 million in 2024. That’s money that used to require going public through an IPO. Today, these companies can scale, grow, and dominate markets without touching the public exchanges.

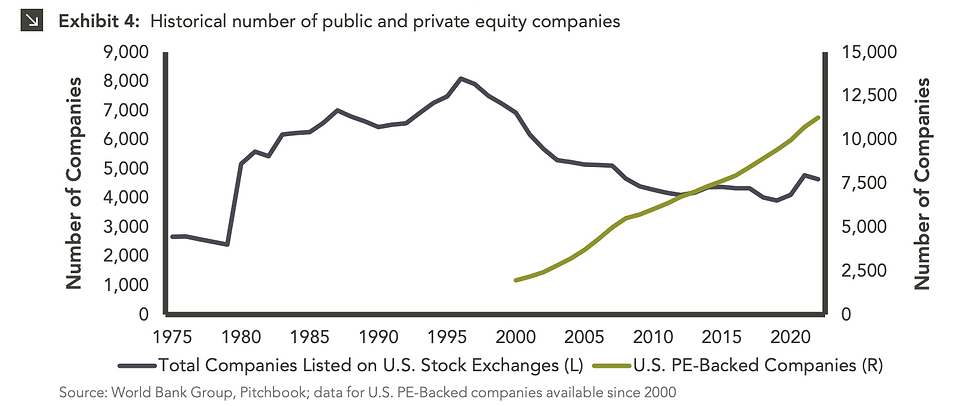

This trend has significant consequences for investors like us. The number of publicly listed U.S. companies has been cut nearly in half since 1996, while the number of private equity–backed companies has swelled to over 11,000. Many of the high-quality, innovative firms that would once have been today’s small-cap darlings are instead maturing behind closed doors in private markets. By the time they IPO, much of that explosive “aggressive growth” has already been captured by private investors【Marquette Associates】.

Defining Aggressive Growth at Whitaker-Myers

At Whitaker-Myers, when we talk about Aggressive Growth, we mean exposure to both mid-cap and small-cap stocks. Because of the challenges in the small-cap space, we generally allocate about half of this category to mid-caps.

Why? Because mid-caps have been less affected by the private equity boom. They still offer tremendous upside, and the roster includes names like:

Invesco Ltd. (IVZ) – a global investment management firm with scale and growth potential in asset management.

Smithfield Foods (SFD) – a leading food producer that recently IPO’d, showing how mid-sized companies can still thrive in public markets.

These are the types of companies that embody aggressive growth—still climbing, still innovative, but with proven business models.

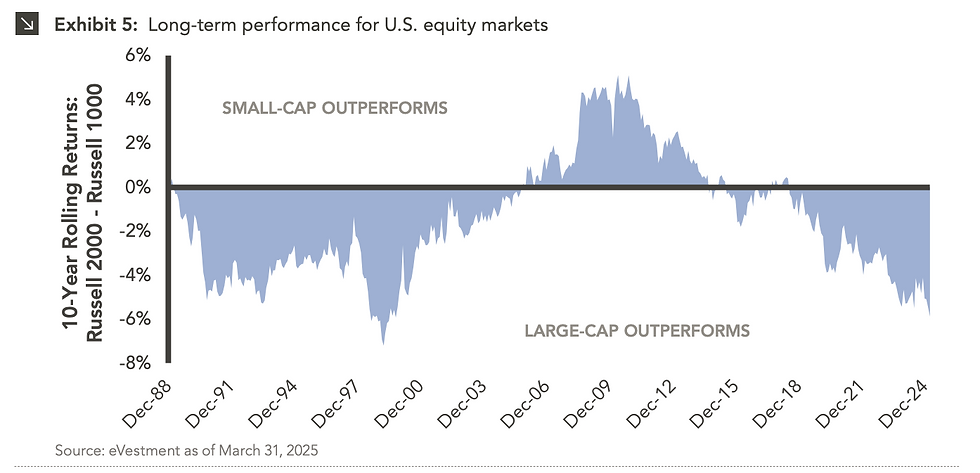

Small caps, on the other hand, have had a tougher run. The Russell 2000 has underperformed the Russell 1000 in 10 of the last 11 years【Marquette Associates】. Some of that is due to quality—over 40% of Russell 2000 companies are currently non-earners. However, a significant driver is that many of the best small companies never reach public markets, instead remaining private.

iCapital has also done some nice research in this space. According to their article, "Private Equity Can Add Diversification to Your Public Index Holdings", they cite that private equity has invested $2.1 trillion in the U.S., and as you can guess, most of that is going to what once were small and mid-sized publicly traded companies. To put $2.1 trillion into perspective, they remind their readers that the average value of the entire Russell 2000, which is about 40% of all U.S. public companies, was $2.5 trillion over this same time period. So, yes, private equity is coming, and it is not going anywhere.

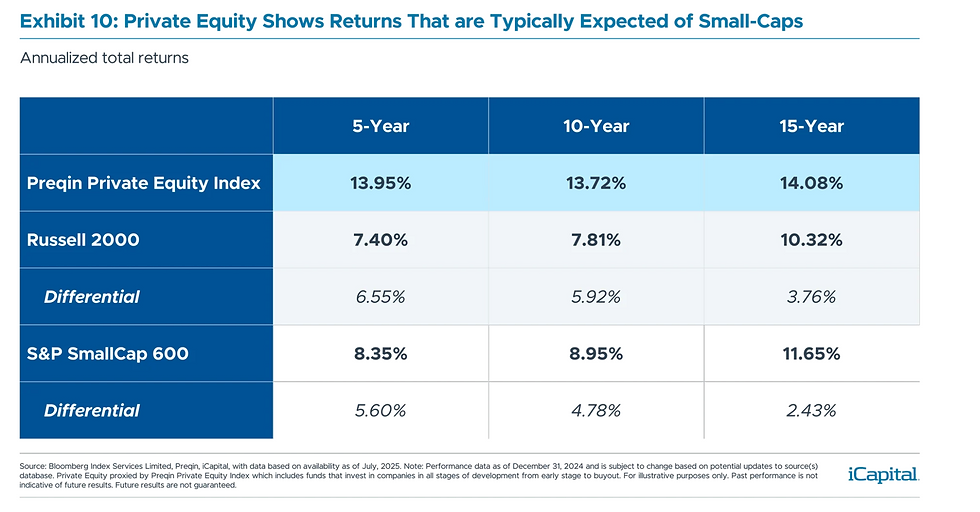

The reason for investing in small-cap stocks is certainly diversification. However, you also aim to achieve optimal performance from that diversification. As illustrated in iCapital's chart below, the Preqin Private Equity Index has surpassed both major aggressive growth benchmarks in both the short and long term. Given the emphasis, funding, and inclination to remain private longer, our investment committee doesn’t anticipate a change anytime soon. However, as you’ll read below, one of our top partners believes that small caps have potential for growth.

Tom Lee’s Bullish Case for Small Caps

Even with all these headwinds, there’s still reason for optimism. Our research partner, Tom Lee at FS Insights, has been vocal that small caps may be on the verge of a comeback. Why? Because they’ve been beaten down for so long. Historically, when an asset class underperforms this severely—such as small caps against large caps for more than a decade—it sets the stage for mean reversion. In other words, the pendulum eventually swings back the other way. With valuations for high-quality small caps looking attractive, Tom Lee argues that the next big run in the market could be led by small-cap stocks.

What This Means for Investors

Does this mean aggressive growth is dead? Not at all. However, it does mean we have to be more strategic about where we find it.

Mid-caps remain a sweet spot. They provide the innovation and growth we look for, with less risk than the most speculative small caps.

Small caps still have a place. While the universe has shrunk, valuations are more attractive, and mean reversion suggests a small-cap revival is possible.

Private equity has changed the game. A portion of what used to be “public aggressive growth” has migrated to the private side. Investors need to understand this dynamic, even if they don’t directly invest in private equity themselves.

The Bottom Line

At Whitaker-Myers, we believe in keeping investing simple, disciplined, and long-term focused. Aggressive growth still plays a vital role in building wealth over the long term, but the playing field has shifted. With companies staying private longer, the small-cap universe looks different from what it did a generation ago.

That’s why we balance our aggressive growth allocation between mid-caps and small-caps, and for appropriate investors, even private equity—capturing the best of both worlds while staying true to the time-tested principles that have helped families build wealth for decades.

Should you consider private equity as a replacement or a complement to your small-cap exposure? That is only a question you and your financial advisor can answer together. One thing to keep in mind is that many private equity strategies still require a minimum level of net worth, income, or investment assets, as you are investing in an asset class that differs significantly from a public investment, most notably in terms of access to liquidity from the investment. If you wonder if this is the right step for you, please contact your Financial Advisor today.

Because at the end of the day, investing isn’t about chasing fads—it’s about owning great companies, sticking with your plan, and letting time and compound growth do the heavy lifting.